The multifamily market is entering a rebalancing phase as construction slows and demand continues to rise. Demographic shifts—like a growing renter base and rising homeownership costs—are pushing more households into rental housing, especially in affordable segments. LPG sees this as a strategic moment to invest. While short-term softness exists, long-term fundamentals remain strong. Our integrated platform is built to seize this window of investment opportunity.

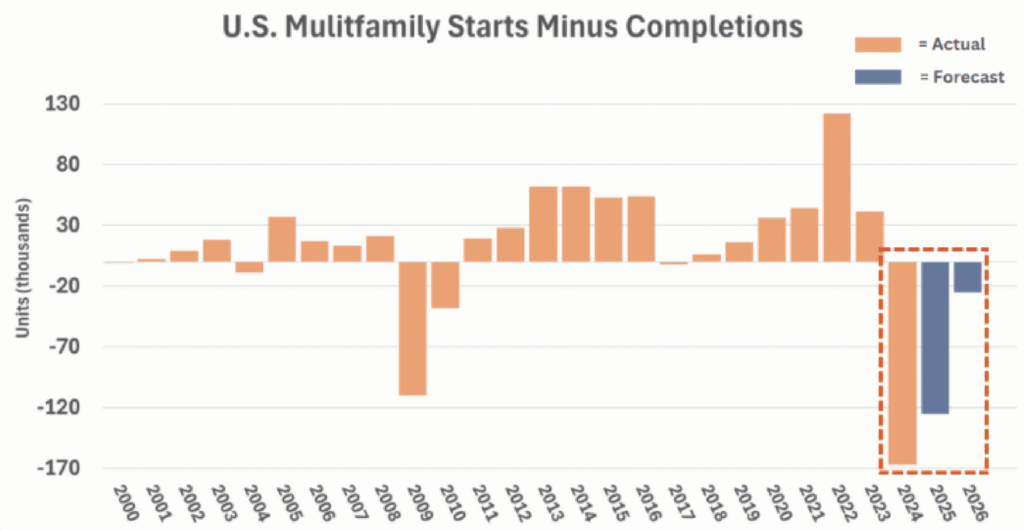

The chart below illustrates the historic supply gap and forecasted tightening in new multifamily deliveries—highlighting the strategic window for entering or expanding multifamily portfolios in 2025 and beyond.

LPG is aligned with five key trends that define the current multifamily investment landscape

Real estate values corrected significantly from mid-2022 through early 2024. As inflation stabilizes and rate cuts are expected in 2025, investor momentum is returning. LPG is actively pursuing high-quality assets at below-replacement costs in strong locations.

The U.S. remains undersupplied by over 3 million units due to over a decade of underbuilding. Demographic trends—including a diversifying renter base and elevated homeownership costs—continue to fuel long-term rental demand.

New starts have dropped 42% since 2022. As supply contracts, this opens the door for accelerating absorption and rent growth, especially in resilient markets like the Mountain West and the Sunbelt.

Tightened lending conditions are creating demand for alternative capital. This dynamic presents significant opportunity for LPG’s preferred equity and acquisition strategies.

LPG’s targeted markets—including Salt Lake City, Phoenix, Boise, and Denver—offer strong job growth, in-migration, and long-term demand stability that outperforms national averages.

Multifamily properties generate steady, predictable rental income each month, thanks to multiple units and consistent demand. In strong markets, units turn over easily and are quickly re-leased, helping ensure year-round cash flow. For investors seeking a more hands-off experience, hiring a professional property manager allows for true passive income without the burden of day-to-day operations—making it an attractive option for those with limited time or real estate experience.

While real estate markets can fluctuate, multifamily properties tend to appreciate over time, particularly in growing or supply-constrained areas. Investors with a long-term outlook often benefit from market cycles, with multifamily assets historically showing greater resilience during economic downturns compared to other real estate sectors.

Housing remains a basic human need, making multifamily investments relatively recession-resistant. Even during downturns, people still need places to live—and many shift from homeownership to renting, increasing rental demand. This makes multifamily more stable than office or retail properties, which often see significant vacancies in economic slowdowns.

Unlike building a rental portfolio of single-family homes, multifamily investments typically require just one loan for dozens—or even hundreds—of units. This simplifies the financing process and reduces the administrative burden, particularly for new investors. Many lenders are also familiar with the multifamily space, making financing more accessible.

Insurance for multifamily properties is typically more straightforward than for other commercial assets. Providers are well-versed in multifamily underwriting, and policies can often be bundled under a single “blanket” program as a portfolio grows—making coverage easier to manage and often more cost-effective.

Multifamily real estate allows investors to scale efficiently. You can start with a duplex and grow to larger apartment communities without dramatically increasing complexity. This incremental growth makes it easier to build a diversified portfolio compared to other asset types like hotels or shopping centers, which often require larger capital outlays and operational overhead.

Multifamily investments come with substantial tax benefits. Owners can deduct mortgage interest and operating expenses, and take advantage of depreciation—typically over 27.5 years—allowing them to offset much of their taxable income. In some cases, investors may even show paper losses while generating positive cash flow. These tax efficiencies are a major reason real estate remains a core asset in many wealth-building strategies.

With real estate, leverage allows investors to control larger assets using relatively modest equity. As tenants pay rent, the mortgage amortizes, steadily increasing the investor’s equity position. Over time, this compounding effect can significantly boost overall returns, especially when paired with appreciation.

Multifamily properties located in designated Opportunity Zones offer powerful tax incentives, including deferral or elimination of capital gains on qualifying investments. This makes them especially appealing for investors with large gains to shelter while investing in revitalizing communities.

Multifamily isn’t a one-size-fits-all category. Investors can choose from a wide variety of asset types—ranging from duplexes and workforce housing to luxury apartments, student housing, or 55+ communities. Strategies can also vary, from long-term leasing to short-term rentals like Airbnb, offering significant flexibility to suit different investment goals.

Multifamily investing offers flexible entry points. Investors can purchase properties directly, partner through joint ventures, participate in syndications, or gain exposure through real estate funds and REITs. This range of options enables investors to tailor their level of involvement and liquidity preferences while still accessing the benefits of multifamily ownership.

Multifamily real estate offers strong risk-adjusted returns, balancing stable income, capital growth, and inflation protection. With financing leverage, value-add potential, and long-term demand, it often outperforms traditional assets while providing tax benefits and downside protection.

Your First Step

Tell us about your investment goals to unlock tailored opportunities.

Our team will reach out to guide your next steps.

Review detailed insights for each opportunity.

Let’s Build Value Together