Our investment strategy is designed to generate strong, risk-adjusted returns across real estate cycles. Through a diversified approach and disciplined underwriting, we target development, acquisition, and preferred equity opportunities in high-growth U.S. markets—especially in the Intermountain West and Southwest.

We offer tailored investment strategies aligned with risk tolerance, return targets, and investor goals.

Build or acquire A- to A+ assets that generate consistent cash flow with no need for major capital improvement.

Build or acquire and improve affordable multifamily properties to optimize operations, enhance community value, and generate stable returns through government incentives, and long-term demand for affordable housing.

Invest in capital improvements and implement enhanced management oversight to drive operational cash flow growth.

Acquire assets that require major renovation, repositioning, rezoning, or development to generate substantial value creation.

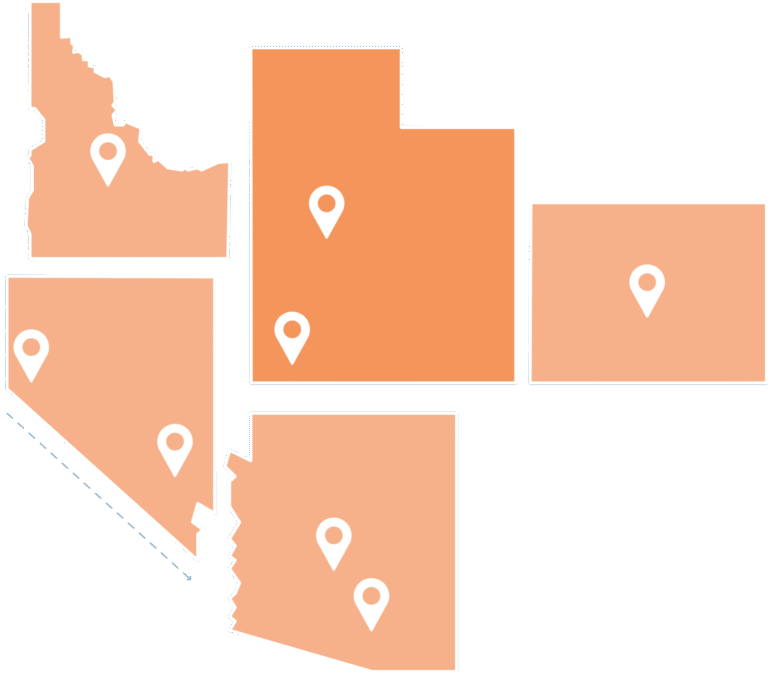

We focus on fast-growing, economically strong markets in the Intermountain West and Southwest.

Target Preferred Equity MSAs

Target Development MSAs

Target Acquisition MSAs

A top boomtown with exceptional livability, steady population growth, and a diversifying economy driving demand for modern housing.

Celebrated for exceptional quality of life, nation-leading job growth, and a thriving tech and business ecosystem that continues to attract talent and investment.

A high-growth metro supported by a diverse economy, strong employment fundamentals, and consistent demand from an active, outdoor-oriented population.

A fast-growing, business-friendly metro with strong job growth, rising in-migration, and year-round outdoor appeal.

A high-growth, cost-advantaged metro with strong in-migration and a rapidly diversifying economy.

See how our opportunities stack up—compare structure, returns, and flexibility to find the right fit for your investment goals.

| Preferred Equity Fund I | Income Producing | Opportunistic / Development | |

|---|---|---|---|

| Strategy | Provide rescue or growth capital to quality sponsors/projects with downside protection. | Reposition undervalued multifamily assets in high-growth markets. | Develop various product types, with a focus on multifamily mixed-use in urban and suburban infill locations. |

| Risk Profile | Low to moderate. | Moderate. | Moderate to high. |

| Investment Objective | Capital preservation with upside through preferred return and profit participation. | Generate value through renovations, improved operations, and rent growth. | Long-term value creation via new development and financial engineering. |

| Structure | Preferred equity with downside protections and control rights. | Joint venture LP equity. | Joint venture LP equity or sole sponsor. |

| Availability | Open-ended evergreen fund. | Deal-by-deal. | Deal-by-deal. |

| Minimum Investment | $ 100,000 | $ 250,000 | $ 250,000 |

| Liquidity | Quarterly redemption available after 12-month hold. | Illiquid during hold period. | Illiquid during hold period. |

| Target Return

(Net of Fees) | 10–15% IRR | 12–18% IRR | 15–25% IRR |

| Net Distribution Yield | 7% preferred return on called capital, 85% share of fund profits after a 12-month hold. | Varies by deal; focus on stabilized yield post-repositioning. | Varies by deal; focus on stabilized yield upon permanent financing. |

| Distribution Cadense | Quarterly. | Typically quarterly or semiannually, post-stabilization. | Typically deferred until stabilization, then quarterly or semiannually. |

| Tax Reporting | K-1 | K-1 | K-1 |

| Management Fee | 1.75% on called capital. | Typically 1.5-2.0% asset management fee. | Typically 1.5-2.0% asset management fee. |

| Performance Fee | 15% promote above preferred return. | Tiered promote structure (e.g., 30% above 12% IRR; 50% above 18% IRR). | Promote structure varies by deal; often 30–40% above targeted IRR. |

| IRAs | Yes, allowed through self-directed IRAs. | Yes, if structured through IRA-eligible vehicles. | Yes, if structured through IRA-eligible vehicles. |

Strategic investment targets across development, acquisition, and preferred equity—focused on high-growth markets, strong returns, and long-term value creation.

Quality location with favorable zoning, market growth, and strong infrastructure.

Class A and B multifamily product in urban/suburban infill areas.

Capital placement for multifamily/mixed-use restructure, development, and acquisition.

Let’s Build Value Together